Pension Fund Master Trust

(legal name “University of Toronto Master Trust”)

Statement of Investment Policies and Procedures

September 23, 2020

To request an official copy of this policy, contact:

The Office of the Governing Council

Room 106, Simcoe Hall

27 King’s College Circle University of Toronto Toronto, Ontario M5S 1A1

Phone: 416-978-6576

Fax: 416-978-8182

E-mail: mailto: governing.council@utoronto.ca

Website: http://www.governingcouncil.utoronto.ca

Preamble

The Governing Council of the University of Toronto (“the University of Toronto” or “the University”) is the legal administrator of the University of Toronto Pension Plan (the “plan”) which provides pension benefits to its employees. This is a contributory defined benefit plan registered under and subject to the Pension Benefits Act (Ontario).

For investment purposes, the University of Toronto Pension Plan holds 100% of the units of the University of Toronto Master Trust (“pension fund master trust” or “PMT”).

The Pension Committee of Governing Council is composed of 11 members of Governing Council and 9 members representing employee groups with members who participate in the pension plan. It has delegated authority1 to act for Governing Council to approve the Statement of Investment Policies and Procedures for the PMT, which includes return objectives, risk tolerance, asset allocation and benchmarks for the evaluation of performance. It is also responsible for approving the terms of the delegation of authority to a University-controlled asset management corporation (or other entity established for a similar purpose) to manage the investment of the PMT and carry out oversight. The Committee reviews, at least semi-annually, reports on the investment of the PMT, with such reports including, among other things, reports on asset mix, investment performance and risk being incurred.

The return expectations, the risk tolerance and the asset allocation for the PMT are established via this University of Toronto Pension Fund Master Trust Statement of Investment Policies and Procedures (“Policy”), which is approved annually by the Pension Committee.

The University of Toronto Asset Management Corporation (“UTAM”) is a separate non-share capital corporation whose members are appointed by the University of Toronto. The University has formally delegated to UTAM the authority for management of PMT investments.

- The Pension Committee performs the role with respect to pension plan administration that was previously delegated by the Governing Council to the Business Board. The general limitations on that delegated authority are identical to those that apply to the Governing Council’s delegation of authority to the Business Board.

Plan Description

Type of Pension Plan

The pension plan is a contributory defined benefit plan registered under and subject to the Pension Benefits Act (Ontario). The University of Toronto is the registered administrator for the plan. The current plan provides defined pension benefits for eligible employees, currently members of the academic, librarian, administrative and unionized staff of the University and its related affiliated organizations. The University of Toronto Pension Plan registration number is 0312827.

Nature of Plan Liabilities

The purpose of the plan is to provide retirement income for members of the plan. The plan provides an annual pension benefit to members based on a prescribed formula applied to years of participation and salary near retirement. Pension benefits are indexed each year by an amount equal to the greater of: a) 75% increase in the Consumer Price Index (CPI) for the previous year up to 8% plus 60% of increase in the CPI above 8%, or b) the increase in the CPI for the previous year minus four percentage points.

As of July 1, 2019, the University of Toronto Pension Plan had 10,584 active members, 6,209 retired members, 3,376 deferred vested members, and 113 members with exempt, suspended or pending status. The average age of active members was 47.3 years, average service was 11.6 years, and average pay was $108,045. As of July 1, 2019, the market value of assets of the plan was $5,322.9 million versus going concern accrued liabilities of $5,562.7 million. Total current service contributions for the year beginning July 1, 2019 are calculated to be $208.7 million and pension payments to pensioners for the year ending June 30, 2019 were $218.9 million. With special payments to amortize the funding shortfall, contributions are expected to exceed benefit payments for the foreseeable future.2

The going concern liabilities are influenced by real interest rates, salary increases, CPI increases, turnover, mortality and retirement age patterns. Appropriate allowance is made for these factors in the assumptions used for actuarial valuation purposes and it is not expected that actual experience will vary significantly from the valuation amounts over the long term.

The duration (a weighted-average measure of interest rate sensitivity) of plan going concern liabilities is 17.0 years. Duration is lengthened due to the plan’s automatic inflation protection, which increases benefit payments over time. The long duration of liabilities is indicative of a long-term investment horizon for the assets.

Going concern liabilities are inflation linked before retirement (based on the final average salary nature of the plan formula) and after retirement (based on the indexing of pension benefits as noted on the previous page). Therefore, the focus is on real investment returns over the long term. Short term nominal market interest rates will impact solvency liabilities (which exclude the value of the plan indexation provision) which in turn can impact cash contributions given the shorter amortization periods associated with solvency deficits.

- Going concern special payments of $51.1 million and solvency special payments of $21.3 million are being paid during 2019-20.

Investment Policies and Procedures

Return Objective, Risk Tolerance and Asset Allocation

In order to meet the planned payment of pensions to current and future pensioners at the existing contribution levels, the return objective is a real investment return of at least 4.0% over rolling 10-year periods, while taking an appropriate amount of risk to achieve this target, but without undue risk of loss.

Asset allocation is defined as the division of a portfolio’s assets among a variety of asset classes in accordance with long-term policy goals. The major decision underlying this choice is the proportion of assets that are allocated to the broad category of equity investments. The aim is to fulfill the policy goals over a full market cycle.

Asset allocation is the primary driver of variability in returns and risk. To define the risk tolerance and to set an appropriate asset allocation, a Reference Portfolio approach has been established.

The Reference Portfolio represents a simple, low cost, passive portfolio which is believed to be appropriate to the PMT’s long-term horizon and associated return target and risk profile. However, over shorter periods of time the Reference Portfolio’s real return may deviate from the longer term expectation. By design, the Reference Portfolio is not exposed to active management decisions and thus is expected to be revised only periodically. Consequently, it also provides a transparent replicable benchmark against which to compare an active management approach.

Given the current environment, it is believed that a Reference Portfolio that is limited to 60% equity exposure (and the associated level of risk) may have difficulty achieving the 4% real return objective. In order to achieve this return objective, successful active management decisions will likely be required. These decisions include altering asset class weights, adding assets and strategies not included in the Reference Portfolio and hiring best in class managers, while ensuring that such changes do not result in the assumption of undue risk.

Given the decision to allow an active management approach, it is prudent to establish a PMT- level risk limit within which UTAM has discretion to make and implement investment decisions with the objective of earning returns above the Reference Portfolio. This PMT-level risk limit is defined as the volatility of the Reference Portfolio plus an additional amount of Active Risk3. The Normal range of Active Risk is -50 bps (i.e. -0.5%) to 150 bps, but it is allowed to go as high as 175 bps for up to 6 months.

Immediate action is required to reduce Active Risk if it exceeds 175 bps. The table below outlines this “traffic light” risk framework. In addition, if Active Risk is below -50 bps, a discussion is required to occur between UTAM and the University. UTAM will provide a periodic risk report to the Pension Committee showing the amount of Active Risk employed.

- Active Risk is defined as the volatility of the PMT actual portfolio minus the volatility of the Reference Portfolio.

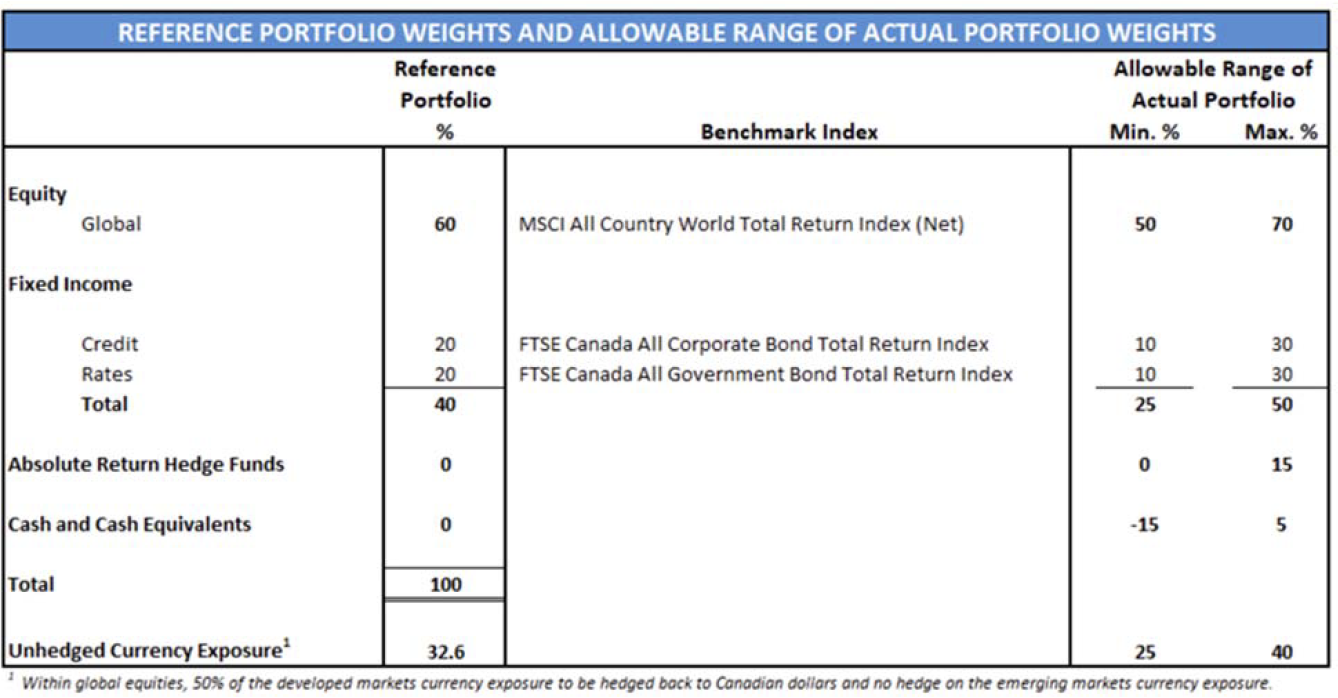

In addition to the Active Risk framework, minimum and maximum weights have been established for each of the major asset groupings within the Reference Portfolio. Taken together, these risk limits are viewed by the University as being large enough to permit UTAM the flexibility to achieve its value-added objective but not so large as to put PMT assets at undue risk of loss relative to the performance of the Reference Portfolio. The Reference Portfolio along with the allowable range of actual portfolio weights is shown in the table below.

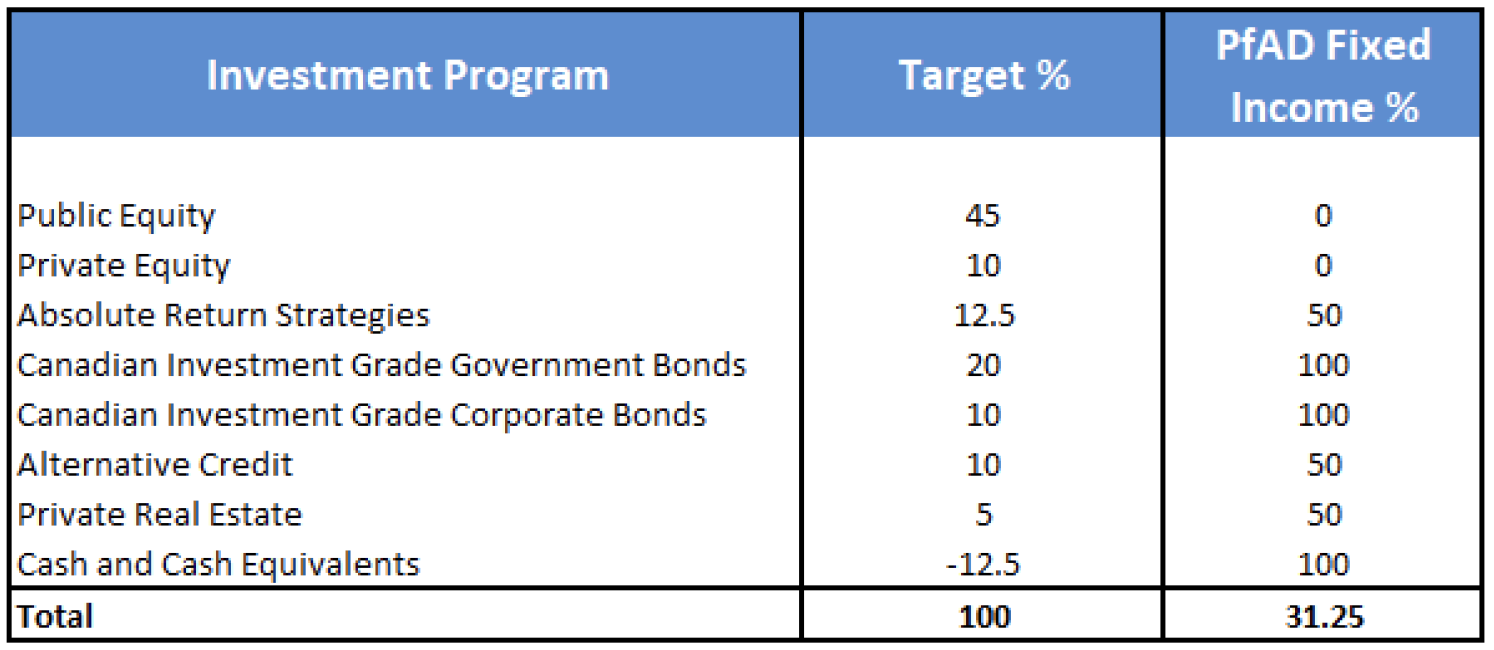

When implementing the Reference Portfolio UTAM may invest in asset classes and strategies (i.e., “Investment Programs”) not included in the Reference Portfolio. However, all Investment Programs

must be approved by the Investment Committee4. The table below shows the current list of Investment Committee approved Investment Programs, target weights, and PfAD fixed income percentages for pension funding and valuation purposes5. Investments in each Investment Program are mapped to one or more of the Reference Portfolio asset classes that best represents the risk profile of each investment for purposes of the allowable range of actual portfolio weights in the table above.

Actual investment performance will be evaluated against the return and risk objectives over time and also compared to the performance of the Reference Portfolio to provide a measure of the degree of success of the active management program.

Actual investment performance will be evaluated against the return and risk objectives over time and also compared to the performance of the Reference Portfolio to provide a measure of the degree of success of the active management program.

Portfolio Diversification

The objectives of diversification are: to reduce the PMT’s total return variability; to reduce the exposure to any single component of the capital markets; and, to increase the expected long-term risk- adjusted returns of the PMT.

To achieve diversification, the PMT may invest, directly or indirectly, in any of the Permitted Investments listed below, as long as the investment adheres to the limitations specified in the Restrictions section of this Policy.

- The Investment Committee reports to the President of the University and provides expert advice to the University Administration, collaborating extensively with the University Administration and with UTAM management on investment objectives and investment activities.

- Ontario Regulation 250/18 introduces a new funding regime for Ontario-registered defined benefit pension plans. The new Regulations include a new additional funding requirement in the form of a reserve factor (known as the Provision for Adverse Deviation, or PfAD) that applies to both accrued liabilities and current service costs. This PfAD depends in part on the target asset mix and the classification of investments as fixed income or non-fixed income, and this classification is required by regulation to be included in the SIPP. The fixed income percentages in the table above have been determined based on criteria established in the new Regulations.

Permitted Investments

Cash: Investments in cash such as deposits with financial institutions, treasury bills, commercial paper, banker’s acceptances, and money market securities.

Commodities: Investments in commodity assets such as energy, industrial metals, precious metals, agriculture, livestock, and investments with commodity attributes such as carbon credits.

Derivatives: Investments in derivatives such as futures, options, warrants, swaps, repurchase agreements and forward contracts on underlying assets such as fixed income, equity, commodity, currency and volatility.

Public Equity: Investments in public equities such as common shares, income trusts, investment trusts, Global Depositary Receipts (GDRs), American Depositary Receipts (ADRs), and preferred shares.

Private Equity: Investments in non-publicly traded equity assets.

Public Fixed Income: Investments in public fixed income assets such as bonds, debentures, notes, asset-backed securities, and term deposits or similar instruments with financial institutions.

Private Fixed Income: Investments in non-publicly traded fixed income assets such as senior and subordinated loans, mortgages, structured credit instruments, and investments with credit attributes such as royalties, insurance, and litigation finance.

Private Infrastructure: Investments in non-publicly traded infrastructure assets.

Private Real Estate: Investments in non-publicly traded real estate assets.

Investments in any investment vehicle (e.g. pooled fund, limited partnership, etc.), all of whose holdings comprise the above permitted investments, are permitted.

Use of Derivatives

Derivatives may be used for hedging, risk management and portfolio rebalancing, including the hedging of foreign currency exposure.

Derivatives may also be used for leverage or as a substitute for more traditional investments if they are based on and consistent with achieving the PMT’s asset allocation and return objectives.

Derivative positions are included in the evaluation of actual investment performance in a manner consistent with all other types of investments.

Some derivatives require the posting of collateral to a counterparty as the price of the derivative changes over time. Exchange of collateral is permitted in accordance with industry standards, and typically documented in a master ISDA6 agreement. Bi-lateral collateral agreements will be used to the extent possible and where considered necessary.

Collateral

The PMT may pledge, charge or otherwise grant a security interest in assets or post margin as required to complete derivatives transactions, complete a short sale or in connection with repurchase transactions. Assets that may be posted as collateral are set out in the legal agreements or are defined by exchanges.

Permitted Pledging

Subject to any restrictions in the PBA and the ITA, PMT may pledge, charge or otherwise grant a security interest in assets or post margin as required to effect transactions in derivatives and repurchase agreements, to secure a permitted borrowing or guarantee, or to effect a short sale.

Permitted Borrowing

Borrowing or providing guarantees on behalf of the PMT is permitted in accordance with the PBA and the ITA.

Currency Hedging

The currency hedging policy of the Reference Portfolio is to hedge 50% of the foreign currency exposure in developed markets and 0% of the currency exposure in emerging markets. This hedging policy results in a policy target unhedged currency exposure of 32.6% with actual exposure allowed to range from 25% to 40% of the PMT’s asset value.

- ISDA (International Swaps and Derivatives Association, Inc.) is the global trade association for over-the-counter derivatives, and maintainers of the industry-standard ISDA documentation.

Liquidity

Portfolio liquidity will be monitored by UTAM on an on-going basis. Short-term liquidity demands arise primarily from the requirement to cash settle various derivative contracts (e.g. currency hedges) and to pay beneficiaries. Liquidity risk is managed by UTAM through a Liquidity Management Policy that includes:

- the minimum amount of cash that must be available to satisfy derivative positions in an unlikely but very negative market environment

- the minimum amount of excess cash required in addition to the amount from 1)

- a stress test that requires the ability of the PMT portfolio to be rebalanced to Reference Portfolio weights within various parameters.

Responsible Investment

The Pension Committee believes that responsible investment includes investing in firms whose sound ESG practices are aligned with the long-term financial best interests of the beneficiaries of the Plan. The Pension Committee believes that the adoption by organizations of sound ESG practices that benefit society and the planet may reduce financial risk over time and offer better long-term value for investors. Similarly, the Pension Committee believes that ESG factors may have a material impact on the long-term financial performance of particular investments. Therefore, in the context of the overall mandate of the Pension Committee to achieve the targeted long-term investment return without undue risk of loss, and recognizing that the significance of ESG factors varies from industry to industry and from place to place, ESG factors, with reference to evolving data and metrics will be integrated into investment analysis and management of the plan’s assets, where relevant and material. Recognizing that this process will take time, the Pension Committee requires that UTAM report annually to the Pension Committee on progress towards meeting this objective.

Environmental, social and governance factors are defined as follows:

- environmental factors are those that relate to a company or industry’s interaction with the physical environment (e.g. climate impact, energy efficiency);

- social factors are those elements of a company’s or an industry’s practices that have a social impact on a community or society (e.g. the impact of a company’s or an industry’s practices on human rights or indigenous rights); and

- governance factors are those that have an impact on how a company is governed (e.g. how it responds to conflict of interest).

Valuation of Investments Not Regularly Traded at a Public Exchange

Many of the investments made by PMT are in comingled/pooled fund structures that are not regularly traded on a public exchange thus necessitating periodic valuations. For those pooled funds that make private market investments (e.g. private equity) the valuations are performed on a periodic basis by the investment manager (generally at least quarterly). Investments in these pooled funds are held by the PMT at their latest reported net asset value and adjusted for known cash receipts and distributions from the reporting date to the valuation date. Valuations for private market investments may also be adjusted for the estimated return from the last reporting date to the valuation date, where this information is available. Investments in other pooled funds are held by PMT at their last reported net asset value and adjusted for the estimated return of the fund up to the valuation date, where this information is available. Pooled funds typically provide independently audited financial statements on an annual basis.

Restrictions

The Policy will adhere to the restrictions specified under the Pension Benefits Act (Ontario), Regulation 909 of the Revised Regulations of Ontario 1990, including Schedule III of the Pension Benefits Standards Regulations, 1985 (Canada), and the Income Tax Act (Canada), all as amended from time to time, and with any restrictions imposed by the Government of Canada.

Additionally, this Policy places a prohibition on investments in tobacco companies. A tobacco company is defined as one that derives 10% or more of its revenue from tobacco products. This restriction also applies to pooled funds where 10% or more of the pool is, or is likely to be, invested in tobacco stocks.

General

Conflict of Interest Guidelines

Anyone involved directly or indirectly with the University’s PMT investments shall immediately disclose to the Pension Committee Chair, at the time of its discussion of the Policy or of matters related to the investment of Pension funds, any actual or perceived conflict of interest that could be reasonably expected to impair, or could be reasonably interpreted as impairing, his/her ability to render unbiased and objective advice to fulfill his/her fiduciary responsibility to act in the best interests of the plan and/or the PMT.

This standard applies to the University and to its employees, to the members of the Governing Council, its boards and committees, and to employees and members of the board of UTAM as well as to all agents employed by them in the execution of their responsibilities under the Pension Benefits Act (Ontario) (the “Affected Persons”).

An “agent” is defined to mean a company, organization, association or individual, as well as its employees who are retained by the University to provide specific services with respect to the investment administration and management of the assets of the plan.

UTAM shall maintain a Code of Ethics that governs employees’ conduct, including situations where potential conflicts of interest may arise.

Disclosure

In the execution of their duties, the Affected Persons shall disclose any conflict of interest relating to them, or any material ownership of securities which could impair their ability to render unbiased advice, or to make unbiased decisions, affecting the administration of the plan and/or the PMT.

Further, it is expected that no Affected Person shall make any personal financial gain (direct or indirect) because of his or her fiduciary position. However, normal and reasonable fees and expenses incurred in the discharge of their responsibilities are permitted upon notification to the University.

No Affected Person shall accept a gift or gratuity or other personal favour, other than one of nominal value, from a person with whom the Affected Person deals in the course of performance of his or her duties and responsibilities for the plan and/or the PMT.

Subject to the provision below regarding UTAM employees, it is incumbent on any Affected Person who believes that he or she may have a conflict of interest, or who is aware of any conflict of

interest, to disclose full details of the situation to the Chair of the Pension Committee immediately. The Chair of the Pension Committee, in turn, will decide what action is appropriate under the circumstances, but at a minimum will table the matter at the next regular meeting of the Pension Committee.

A UTAM employee, who believes that he or she may have a conflict of interest, or who is aware of any conflict of interest, is required to disclose full details of the situation to UTAM’s Chief Compliance Officer, who will determine appropriate action. Where UTAM’s Chief Compliance Officer determines that a material conflict of interest exists, he or she will communicate details of the situation to the Chair of the Pension Committee.

No Affected Person who has or is required to make a disclosure as contemplated in this Policy shall participate in any discussion, decision or vote relating to any proposed investment or transaction in respect of which he or she has made or is required to make disclosure, unless otherwise determined permissible by unanimous decision of the Pension Committee.

Related Party Transactions

The University, on behalf of the plan, may not, directly or indirectly, (i) enter into a transaction with a related party or (ii) lend the moneys of the plan to a related party or use those moneys to hold an investment in the securities of a related party.

The University may enter into a transaction with a related party for the operation and administration of the plan and/or the PMT, if the value of the transaction is nominal and immaterial to the PMT or:

- the terms and conditions that are not less favourable to the PMT than market terms; and

- It does not involve the making of loans to, or investments in, the related party.

For the purposes of this section, only the market value of the assets of the plan and/or the PMT shall be used as the criteria to determine whether a transaction is nominal or immaterial to the PMT.

Affected Persons are considered to be each a “related party”. For this purpose, related parties also include: employees of Affected Persons, a union representing employees of the University, a member of the plan, a spouse or child of the persons named previously, or a corporation that is directly or indirectly controlled by the persons named previously, among others. Related party does not include government or a government agency, or a bank, trust company or other financial institution that holds the assets of PMT, where that entity or person is not the administrator of the plan.

In the case of fixed income or cash equivalent securities issued by a related party that otherwise meet the requirements specified above, such transactions will be considered nominal if they are held within a pooled fund, selected by an investment manager acting independently, and constitute in the aggregate less than 5% of the market value of that pooled fund. In the case of any other asset class, a transaction or series of transactions will be considered nominal if the combined value of all transactions respecting a related party does not exceed 3% of the market value of the plan assets. In determining the amount of any transaction or series of transactions:

- Any contingency or potential liability related to or arising from the transaction or series of transactions must be included;

- If the level of risk attached to any assets of the PMT is affected by the transaction, the total value of these assets must also be included; and

- For this purpose, if the transaction is part of a series of transactions that may continue in the future, the value of all projected transactions must be included.

Securities Lending

The securities of the PMT may be loaned to investment dealers and banks as part of the trustee/custodian’s lending program when it is deemed that such lending may add to the return of the PMT at minimal risk and provided that the loan is collateralized in accordance with industry standards and marked-to-market and adjusted on a daily basis.

Exercise of Proxies and Voting Rights for Public Equities

Investment managers voting proxies or exercising other voting rights associated with any of the PMT investments are expected to vote in the best interests of their clients. In respect of segregated account mandates, this requires that voting is conducted in the best interests of PMT. In respect of commingled funds, it is expected that voting is conducted in the best interests of the commingled fund. UTAM will require investment managers’ proxy voting policies to reflect this standard. UTAM may also direct the voting of proxies in segregated account mandates, and in certain commingled funds, that is in the best interests of PMT but that also takes into account ESG considerations.

UTAM will review proxy voting records of segregated account mandates and commingled fund mandates where it has directed the voting of proxies. Proxy voting reports from pooled fund public markets investment managers will be provided to UTAM where they are obligated by regulation to produce them.

Responsibilities of Investment Managers and Other Professionals

The University has overall responsibility for the plan. The University has delegated certain responsibilities to UTAM and to third party agents.

Investment managers:

The University has delegated investment manager responsibility to UTAM. UTAM will require that each external investment manager:

- In the case of segregated account mandates, invests the assets of the plan in accordance with this Policy (in the case of pooled fund mandates, UTAM will ensure that investment is consistent with this Policy).

- Notifies UTAM of any significant changes in the investment manager’s philosophies and material policies and procedures and key personnel or organization, and otherwise responds to UTAM’s enquiries.

- Reconciles their own records with those of the custodian or administrator regularly or causes this reconciliation to be done by a third-party.

- Files compliance reports as frequently as required by UTAM.

- Invests with the care, diligence and skill that a person skilled as a professional investment manager would be expected to use in dealing with pension plan assets and shall use all relevant knowledge and skill that the investment manager possesses or ought to possess. Investment managers are expected to be in compliance with the standards of professional conduct and the code of ethics administered by the CFA Institute or such other standards that are deemed by UTAM to be satisfactory.

Custodian/Trustee:

The University has overall responsibility for custody of pension assets, appoints the custodian and delegates operational oversight of the custodian to UTAM. The custodian/trustee will:

- Maintain safe custody over the assets of the plan.

-

Execute the instructions of the University, of UTAM and of the investment managers.

-

Record income and provide monthly financial statements to the University and to UTAM as required.

-

Meet with the University and UTAM as required.

Actuary:

The University appoints the actuary. The actuary will perform actuarial valuations of the plan and meet with the University as required.

Accountant (External Auditor):

The University appoints the accountant (external auditor) who will conduct an annual audit of the financial statements of the plan and meet with the University as required.

The University has the authority to retain other consultants/suppliers as it deems necessary from time to time.

Policy Review

This Policy shall be reviewed at least once a year and either confirmed or amended as necessary.

Sheila Brown, Chief Financial Officer

September 23, 2020